0

0 0

0 0

0 0

0The Law in Alabama

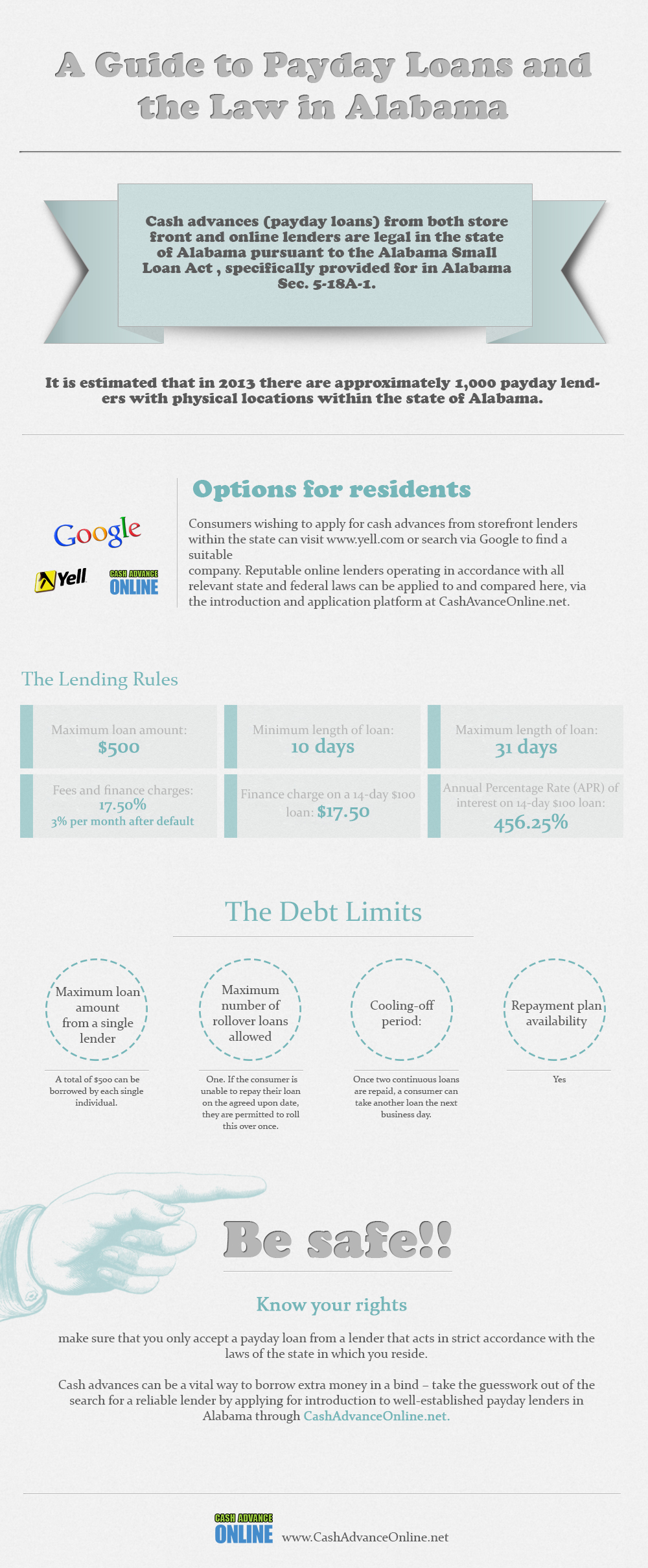

Cash advances (payday loans) from both store front and online lenders are legal in the state of Alabama pursuant to the Alabama Small Loan Act , specifically provided for in Alabama Sec. 5-18A-1.

It is estimated that in 2013 there are approximately 1,000 payday lenders with physical locations within the state of Alabama.

Options for residents

Consumers wishing to apply for cash advances from storefront lenders within the state can visit www.yell.com or search via Google to find a suitable company. Reputable online lenders operating in accordance with all relevant state and federal laws can be applied to and compared here, via the introduction and application platform at CashAvanceOnline.net.

The Lending Rules

The following lending rules must be compiled with:

- Maximum loan amount: $500

- Minimum length of loan: 10 days

- Maximum length of loan: 31 days

- Fees and finance charges: 17.50%; 3% per month after default

- Finance charge on a 14-day $100 loan: $17.50

- Annual Percentage Rate (APR) of interest on 14-day $100 loan: 456.25%

Alabama Payday Laws Infographic (scroll down if you want to use it on your website)

The Debt Limits

In order to limit the amount of outstanding loans a consumer can have, the following debt limits must be adhered to in Alabama for cash advances:

- Maximum loan amount from a single lender: A total of $500 can be borrowed by each single individual.

- Maximum number of rollover loans allowed: One. If the consumer is unable to repay their loan on the agreed upon date, they are permitted to roll this over once.

- Cooling-off period: Once two continuous loans are repaid, a consumer can take another loan the next business day.

- Repayment plan availability: Yes

The Collection Restrictions

In addition, there are certain additional collection restrictions mandated against lenders in the instance of a borrower’s repayment bouncing or their failure to repay part, or all, of their loan:

- Maximum collection fees: Lenders can collect a maximum of $30 “non-sufficient funds” fee. Attorney fees can be up to a maximum of 15% of the face amount of the payday loan or check.

- Criminal proceedings: Lenders cannot initiate criminal proceedings against borrowers unless a check or repayment is returned due to their bank account being closed.

Regulatory information

In the instance that either a store front or online lenders offers a payday loan to an Alabama resident in contravention of the above rules and parameters, consumers are advised to contact the Alabama Banking Department to protect themselves and exercise their statutory rights:

- Name of Regulator: Alabama Banking Department

- Address: P.O. Box 4600 Montgomery AL 36103

- Phone: (334) 242-3452

- Fax: (334) 353-5961

- Regulatory contact personnel: Arlene Baldwin, Consumer Services Specialist, Bureau of Loans.

- Link to complaint form: File a complaint here

- Website: http://www.bank.state.al.us/

Be safe

Know your rights – make sure that you only accept a payday loan from a lender that acts in strict accordance with the laws of the state in which you reside.

Cash advances can be a vital way to borrow extra money in a bind – take the guesswork out of the search for a reliable lender by applying for introduction to well-established payday lenders in Alabama through CashAdvanceOnline.net.

Download this infographic.