By the passing day, increasing number of reports regarding loan scams have been received by the Washington State Department of Financial Institutions (DFI). These scams are being conducted by certain people who are claiming to be representatives of firms such as Cash Advance America, Advance America Payday Loans, and Advance America.

By the passing day, increasing number of reports regarding loan scams have been received by the Washington State Department of Financial Institutions (DFI). These scams are being conducted by certain people who are claiming to be representatives of firms such as Cash Advance America, Advance America Payday Loans, and Advance America.

How does it work?

A large number of consumers have been the recipients to a lot of phone calls from various people who call and claim to be representatives of these 3 major firms. When consumers receive these scam phone calls, the callers usually offer them loans and borrowings in an exchange for a free, to be paid up front.

In these scam phone calls, customers usually claim to never have applied for any such payday loan amounts, and the callers are insisting that they have been calling in order to discuss the online payday loan applications of these consumers.

As reported by one of the consumers, as soon as she refused to transfer the money to the scam caller, she received a threat that legal action would be taken against her. Some of the consumers, who actually made the payment of the upfront fee, did not receive any loan as was promised by the callers. Such loan offers were also made via email to most of the consumers.

As reported by one of the consumers, as soon as she refused to transfer the money to the scam caller, she received a threat that legal action would be taken against her. Some of the consumers, who actually made the payment of the upfront fee, did not receive any loan as was promised by the callers. Such loan offers were also made via email to most of the consumers.

In addition to this, a consumer from Washington received a multitude of harassment calls from someone who claimed to be a representative of Cash Advance America. This particular caller said that the consumer owed the company a debt of a payday loan for the year 2007 and turned down the request to provide any further details pertaining to the debt. And the consumer said that he did not borrow any such loan in the past.

Advance America Payday Loans and Cash Advance America use the contact information that is mentioned below. But the Washington State of Department of Financial Institutions has not licensed these two companies to provide loans or do any business in Washington.

Email Addresses

americacashadv@gmail.com, adam.smith@unitedcashadvance.in, cashadvanceamericas@rocketmail.com

Phone Numbers

818-570-6222, 321-576-1077, 206-855-3292, 315-625-1913, 716-240-0028, 254-212-1137, 707-533-1466, 360-362-5979, 206-973-2544

Advance America is, however, licensed to provide loans. But this company that is licensed is not a part of the scams that have been mentioned above.

Recommended Solutions

DFI is recommending consumers to deal with only lenders that are licensed properly to conduct any business, and one way for consumers to determine if lenders are in fact licensed properly is by using a feature on the DFI website that reads Verify a License.

If consumers have any queries about laws pertaining to debt collection, they are advised to contact the Federal Trade Commission.

One thing to note is that debt collectors are not authorized to state that it is a crime if you fail to repay a debt. Also, they cannot place calls before 8am or after 9pm, and are not authorized to abuse or harass debtors. Adding to this, consumers’ employment addresses cannot be contacted by them.

Reporting a Fraud

If the residents of Washington find themselves to have any suspicions regarding any sort of unlicensed activities by payday lenders, they should contact or place a complaint to DFI. And if consumers belong to some other state, they should visit NMLS consumer access, where they can find their respective state regulator.

If consumers feel victimized by loan scams, they can either contact the Federal Trade Commission, or the Consumer Financial Protection Bureau. This should be done because consumers become victims of identity theft if scammers have access to their social security numbers and information regarding their bank accounts and should immediately take precautionary methods.

If consumers think that they are victims of any loan scams that involve the internet, then they are advised to immediately contact the Internet Crime Complaint Center by visiting their website online.

All consumers who think that they are victims of loan scams, and have concerns regarding the confidentiality of their personal financial information can either contact their banking institution, or seek help by contacting the 3 main credit bureaus.

Read more about the FTC guidelines to avoid spam here.

It is time for the consumer to hit back! No more sleepless nights! Identify them, know their dirty little tactics, gather evidence, and with the help of the FTC, sue them, fight back and get paid! Every consumer deserves to be respected, and no collector may violate his rights nor demean his character and none of them may hinder a consumer’s lifestyle nor harass or threaten them into paying.

It is time for the consumer to hit back! No more sleepless nights! Identify them, know their dirty little tactics, gather evidence, and with the help of the FTC, sue them, fight back and get paid! Every consumer deserves to be respected, and no collector may violate his rights nor demean his character and none of them may hinder a consumer’s lifestyle nor harass or threaten them into paying. By the passing day, increasing number of reports regarding loan scams have been received by the Washington State Department of Financial Institutions (DFI). These scams are being conducted by certain people who are claiming to be representatives of firms such as Cash Advance America, Advance America Payday Loans, and Advance America.

By the passing day, increasing number of reports regarding loan scams have been received by the Washington State Department of Financial Institutions (DFI). These scams are being conducted by certain people who are claiming to be representatives of firms such as Cash Advance America, Advance America Payday Loans, and Advance America.

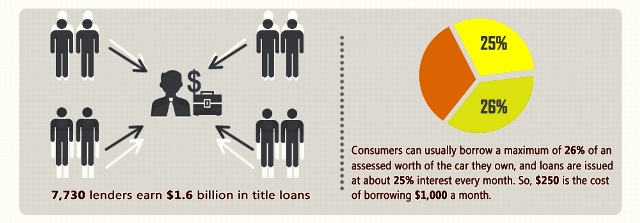

According to the Center for Responsible Lending, assessments of the ability of borrowers to repay loans should be conducted by title loan firms before they can issue loans and interest rates should be capped at 36%.

According to the Center for Responsible Lending, assessments of the ability of borrowers to repay loans should be conducted by title loan firms before they can issue loans and interest rates should be capped at 36%.

The US banks that are looking at lower incomes from overdraft fees and debit cards are increasing their marketing tactics to focus on the provision of short term loans. This has prompted the interest of regulators who are starting to question banks as to whether they are on their way to providing the same risks to borrowers as the payday lending industry.

The US banks that are looking at lower incomes from overdraft fees and debit cards are increasing their marketing tactics to focus on the provision of short term loans. This has prompted the interest of regulators who are starting to question banks as to whether they are on their way to providing the same risks to borrowers as the payday lending industry.