0

0 0

0 0

0 0

0 It’s official – payday loans are being used by more people to pay for rent, rather than to cover a one-time cash flow shortage. New figures from a report by the Pew Charitable Trusts show that a massive 7 out of 10 borrowers use payday loans for rent and other types of regular expenditure.

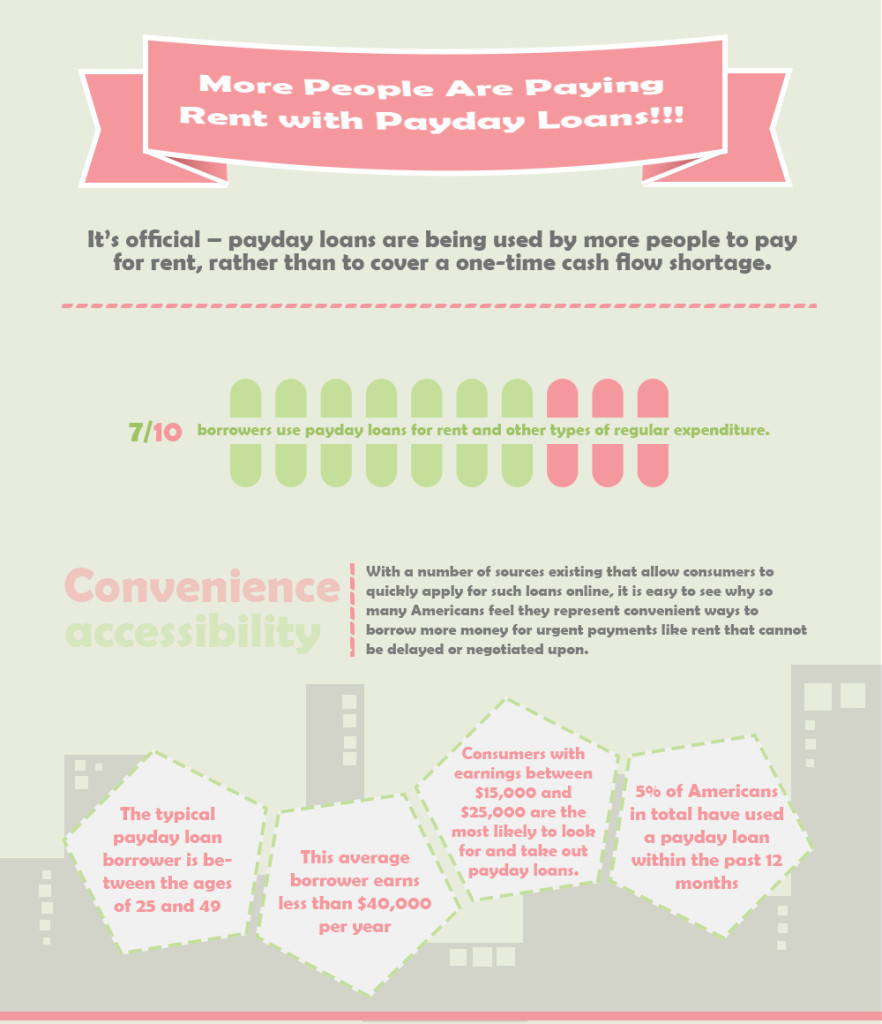

It’s official – payday loans are being used by more people to pay for rent, rather than to cover a one-time cash flow shortage. New figures from a report by the Pew Charitable Trusts show that a massive 7 out of 10 borrowers use payday loans for rent and other types of regular expenditure.

Convenience and accessibility are two major factors

With a number of sources existing that allow consumers to quickly apply for such loans online, it is easy to see why so many Americans feel they represent convenient ways to borrow more money for urgent payments like rent that cannot be delayed or negotiated upon.

Rent with Payday Loans Infographic (scroll down if you want to use it on your website)

Multiple loans to pay the rent

In addition, the report shows that the poorest Americans are using a number of payday loans strung together in order to cover their rental payments from month to month. This often means quickly borrowing one or two loans in one transaction and then rolling those loans over again to the next wage cycle in order to have enough to cover the next month’s rent.

While not an ideal method, and one that is actually not allowed by many states’ payday loan lending regulations, this is a common practice that struggling consumers use out of necessity, particularly if they do not want to borrow from banks or other traditional institutions in order to avoid receiving a credit check.

The survey

The Pew report looked at a total of more than 33,000 adults in order to examine the purposes of their cash advance loan borrowing activities. Various aspects of data were collected and compared in order to create a snapshot of the average payday loan user.

Demographic data shows some surprising facts

The report’s demographic data shows the following:

- The typical payday loan borrower is between the ages of 25 and 49

- This average borrower earns less than $40,000 per year

- Consumers with earnings between $15,000 and $25,000 are the most likely to look for and take out payday loans.

- 5% of Americans in total have used a payday loan within the past 12 months

How would consumers cope without their payday loans?

What would these consumers do if they were not able to find payday loans quickly, from reputable sources and in the amounts that they need to borrow? The answer appears to be that they would miss rent payments and potentially jeopardize their living situations. The implications of this could be catastrophic for thousands of people.

Housing costs as a basic expense

Although rent is a regular, reoccurring expense, covering housing costs are essential payments which need to be met as a priority. For the high percentage of consumers who are accessing payday loans for this purpose, the set interest charges, lack of credit check and regulated level of fees applied make them more than worthwhile loans to take out. If forced to choose between paying a $90 finance fee and being homeless, it is clear what consumers would select.

Just how popular are payday loans currently?

Payday loans are a very fast growing area of consumer finance. Compared to 20 years ago, when storefront lenders were a rare sight, in 2003 alone there were around 3,000 storefront lenders. The Pew report states that today there are around 20,000 storefront lenders, with an additional large number of lenders operating online. Some of the online lenders can be compared through aggregation websites, which allow consumers to search for loans and compare without any obligation to say yes.

Do you use payday loans to cover rent payments? Have you ever had to borrow money to pay the rent? What do you think about the Pew study? Share your thoughts with our readers in the Comments section, below!

Download this infographic.