0

0 0

0 0

0 0

0 The Center for Responsible Lending has just published a new study looking into the overall status of cash advance lending in the U.S. and the impact it has on households. According to the study, failure to read and understands interest rates and fees is one of the biggest consequences faced by unwitting consumers. This has led to American borrowers paying $3.4 billion in cash advance fees per year, many of which charges are unwarranted and illegal.

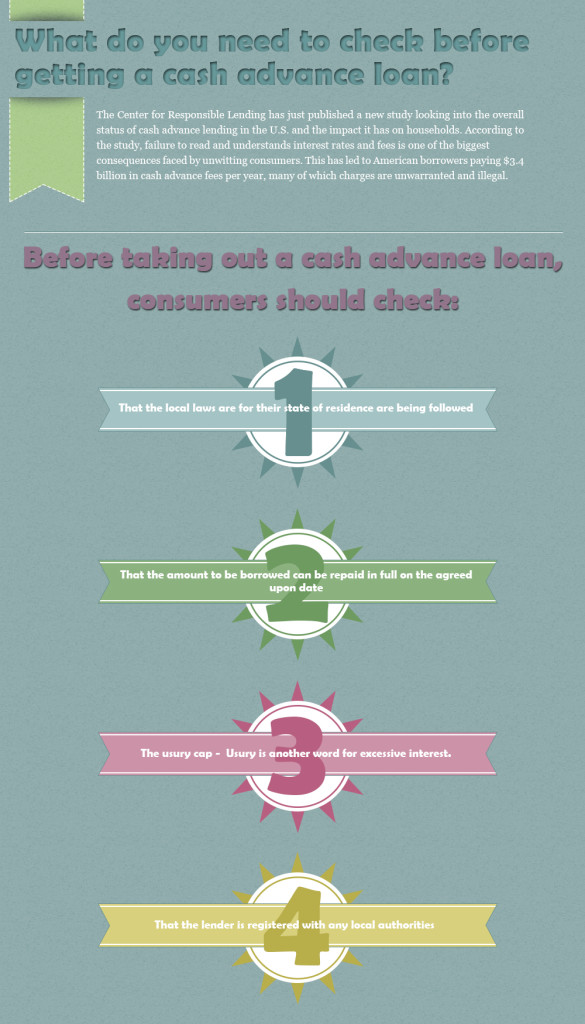

The Center for Responsible Lending has just published a new study looking into the overall status of cash advance lending in the U.S. and the impact it has on households. According to the study, failure to read and understands interest rates and fees is one of the biggest consequences faced by unwitting consumers. This has led to American borrowers paying $3.4 billion in cash advance fees per year, many of which charges are unwarranted and illegal.

With online lenders being able to pay out cash advance loans in a matter of hours or minutes in some cases, it is vital that consumers are aware of what taking such a loan entails before committing to it.

cash advance loan Infographic (scroll down if you want to use it on your website)

Before taking out a cash advance loan, consumers should check:

1) That the local laws are for their state of residence are being followed

Each state has its own rules and regulations regarding how much can be borrowed via a payday loan, who can lend it, for how long and what charges can be applied. Although several U.S. states have recently made their local laws more stringent, The Consumer Financial Protection Bureau is yet to formulate universal rules governing cash advances. Therefore, consumers should be totally clear that a loan complies with state laws before acceptance. Read through the Terms & Conditions of a loan offer with a fine-toothed comb, taking time to cross-reference fees stated with the legal limits.

2) That the amount to be borrowed can be repaid in full on the agreed upon date

A payday loan should only be borrowed if a consumer has enough income to repay the entire loan on the repayment date and enough to cover their monthly expenses. If this is not possible, it is imperative to be aware of any possible rollover period that can apply. Some states allow borrowers to roll-over the loan a number of times (typically, anything from once to 4 times). There is usually an additional fee for this too – consumers should check what the numbers are for each relevant state.

3) The usury cap

Usury is another word for excessive interest. Usury caps on interest on cash advance loans have been implemented by many states in recent years, along with a blanket cap for loans made available to military personnel (36%). For example, payday lenders in Arizona and Montana cannot charge interest that is more than 36% of the total amount borrowed. In Ohio, the figure cannot be more than 28%. Washington state and Delaware have instead decided to limit the number of cash advance loans that an individual can have in any 12 month period, in a bit to reduce the amount of charges and fees that can be accumulated by a single borrower. More than half of the U.S. states have not imposed limits on the interest that lenders can apply. Accordingly, would-be borrowers in such states should select lenders paying close attention to total fees and charges that apply.

4) That the lender is registered with any local authorities

Each state’s banking department usually requires lenders to be authorized and registered in order to deal in financial products such as cash advance loans. In the instance where a disagreement, dispute or problem regarding a loan arises, the state banking department should be a consumer’s first port of call in order to file a complaint, or make a request for punitive action to be taken against a lender that has acted in bad faith. Again, registration credentials and reputations of online and storefront cash advance lenders should be thoroughly vetted before agreeing to accept a loan. However, state banking departments can also take action against unregistered lenders after the fact is discovered.

Download this infographic.