0

0 0

0 0

0 0

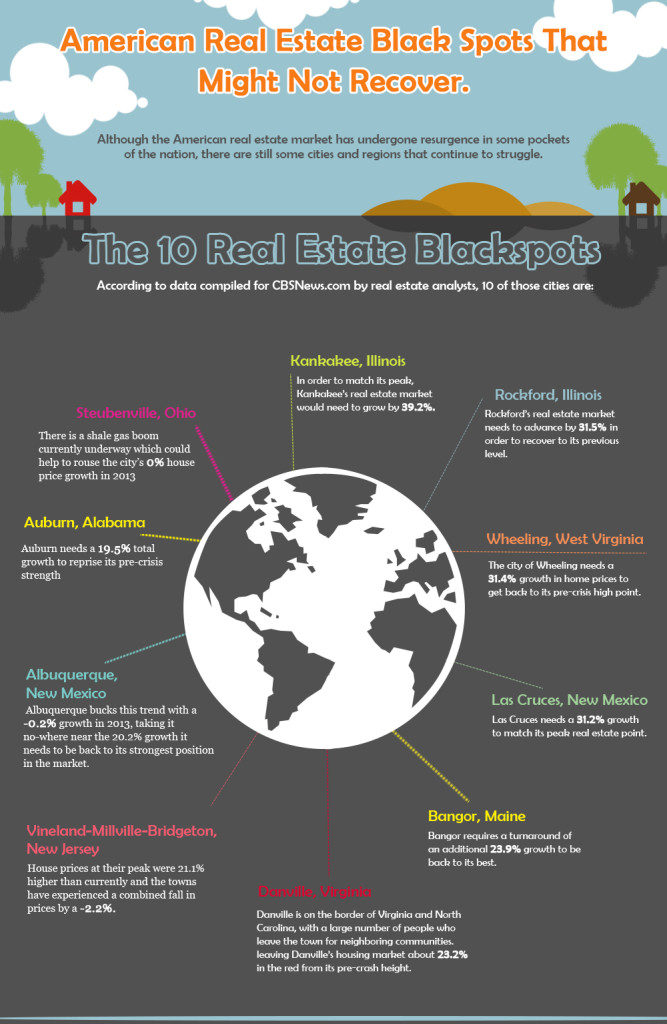

0 Although the American real estate market has undergone resurgence in some pockets of the nation, there are still some cities and regions that continue to struggle.

Although the American real estate market has undergone resurgence in some pockets of the nation, there are still some cities and regions that continue to struggle.

The good

Some of the cities that were decimated the most dramatically by the real estate crash, such as California, Florida and Nevada, are going from strength to strength as they grow. For example, in Modesto, California, the average house price is down by 49% from its pre-real estate crisis peak but it has still managed to climb up by an additional 30% since September 2012.

The bad

But at the other end of the scale, cities such as Farmington, New Mexico, are recovering at a snail’s pace. The average house price there plummeted 20% from its zenith and has only grown by an almost negligible 0.03% in 2013. If this is a pace at which real estate prices in Farmington will get back to their pre-crisis peak, experts estimate that it would take a massive 200 -300 years for the city’s housing market to regain buoyancy. As such, it is obvious that there exist some cities which may never allow homeowners to make back the money they have lost since purchasing their properties.

American Real Estate Blackspots Infographic (scroll down if you want to use it on your website)

The 10 Real Estate Blackspots

According to data compiled for CBSNews.com by real estate analysts, 10 of those cities are:

1.Kankakee, Illinois

In order to match its peak, Kankakee’s real estate market would need to grow by 39.2%. In 2013, it has experienced a further decline of -3.5%, largely due to its lack of population growth and an unemployment rate that has refused to dip below 10% since the middle of 2008. Despite a huge number of foreclosed homes, these are not boosting average house prices. Kankakee needs a major turnaround economically if its real estate market wants to see any chance of recovering its huge 39% drop in value of properties.

2. Rockford, Illinois

Rockford’s real estate market needs to advance by 31.5% in order to recover to its previous level. Rockford has had a very high unemployment rate of 20% at its largest and it currently is 10%. This is the biggest reason for the continuing depression of house prices. Unless unemployment decreases and jobs are created in the city, the housing market will continue to be in strife.

3. Wheeling, West Virginia

The city of Wheeling needs a 31.4% growth in home prices to get back to its pre-crisis high point. In 2013, the growth was -9%, representing a huge blow. The town is experiencing a very high number of foreclosures and an ever-shrinking population, neither of which bode well for its real market’s future recovery.

4. Las Cruces, New Mexico

Las Cruces needs a 31.2% growth to match its peak real estate point. Growth in 2013 has been stilted at -0.1%. The city is still growing but it would need to boom in population very quickly in order to cause much change to the housing market.

5. Bangor, Maine

Bangor requires a turnaround of an additional 23.9% growth to be back to its best. Growth in house prices in 2013 has been -1.4%, which when combined with the spate of foreclosures that continue to blight the town, keeps the average house price extremely low. However, if distressed properties are removed from the data, Bangor is slowing getting back on its feet.

6. Danville, Virginia

Danville is on the border of Virginia and North Carolina, with a large number of people who leave the town for neighboring communities. According to estimates from the Census, more than 25% of the town’s population has left since the 1980s. This makes it easy to see why the average house price in 2013 has fallen by a further -0.5%, leaving Danville’s housing market about 23.2% in the red from its pre-crash height.

7. Vineland-Millville-Bridgeton, New Jersey

These three medium-sized towns are located on the southern part of New Jersey, roughly equidistant between Philadelphia and Atlantic City. House prices at their peak were 21.1% higher than currently and the towns have experienced a combined fall in prices by a -2.2%. According to CoreLogic, The towns’ housing markets have generally experience a very slow growth of 4.1% in the last 12 months, compared to a 12.4% growth nationally.

8. Albuquerque, New Mexico

The entire Southwestern peninsula of the United States has experienced profound drops in house prices, with Phoenix and Las Vegas faring especially badly. However, while Arizona and Nevada have on the whole experienced respectable double-digit growth during recovery, Albuquerque bucks this trend with a -0.2% growth in 2013, taking it no-where near the 20.2% growth it needs to be back to its strongest position in the market.

9. Auburn, Alabama

This town is also the location of Auburn University. As such, students comprise nearly a 50% proportion of the population, perhaps accounting for the growth in the housing market in 2013 of just -2.3%. Auburn needs a 19.5% total growth to reprise its pre-crisis strength, which may be possible if its population continues to grow at its current rate.

10. Steubenville, Ohio

Steubenville has hit the headlines for negative reasons recently. It is a working-class town with a struggling economy based on steel mills that closed down. There is a shale gas boom currently underway which could help to rouse the city’s 0% house price growth in 2013, but it may not have enough potential to take the prices to their pre-real estate crisis growth of 17.9%.

Download this infographic.