0

0 0

0 0

0 0

0

The Center for Responsible Lending mentioned in a report, which was issued this week, that consumers who have exhausted their borrowing options are the ones who use their automobiles and vehicles as collateral and pay $3.5billion in interest each year for title loans, also known as auto title loans. The report illustrated that on an average, loans are priced at $950, and borrowers have to repay the loans within 10 months. This means that they spend $2,140 to borrow the amount.

Title Loans vs Payday Loans

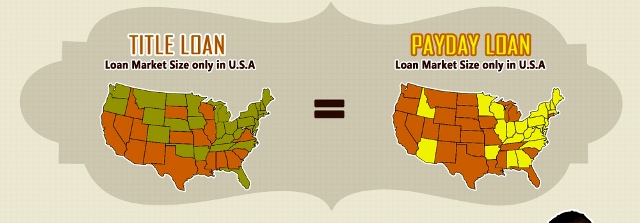

The author of the report, Uriah King, said that the title loan market size is approximately equal to the payday loan market size, which has been the target for regulators. Title loans are only permitted in about half of the states of the U.S.A. and the size of these loans is what forms the basis of this comparison.

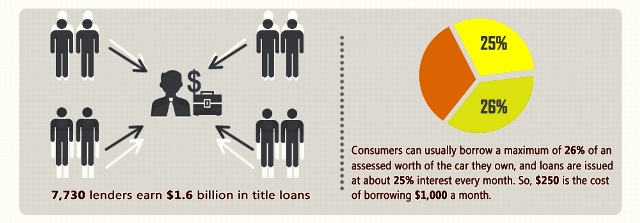

This dictates that title loans are about 3 times larger than payday advances and on an annual basis, around 7,730 lenders earn $1.6 billion in title loans. Consumers, who are unable to use options like credit cards for short term loans, are drawn to the television ads at night that show title loans as their best solution.

How Much Can You Borrow

Consumers can usually borrow a maximum of 26% of an assessed worth of the car they own, and loans are issued at about 25% interest every month. So, $250 is the cost of borrowing $1,000 a month.

The Risk

Borrowers can lose their cars to repossession if they default in payment, while lenders face no risk whatsoever.

Repossession leads to additional fee costs of $300 to $400 leading to repayment of outstanding loans almost always. Before the Consumer Financial Protection Bureau (CFPB) was created, lenders were only governed by state laws and didn’t have to answer to regulators of federal lending.

Lenders normally do not make assessments of the ability of borrowers to repay loans. Some ads also boast that no credit history checks are required and employment doesn’t need to be proved to borrow title loans.

King mentioned that title loans cannot be repaid in a month as middle class families will struggle to pay loans of $1,200 which is the amount of the principal, plus interest. What happens is that the loans are then renewed per month for 10 months on average.

Title Max and Loan Max are the top two title loan issuing companies. Title Max provides more than 2,000 customers with auto title loans per day.

American Association of Responsible Auto Lenders is a trade group set up by the title loan industry. This group, in 2011, sent a letter to CFPB in which they argued that their customers preferred title loans to late fees and overdraft fees that could have negative credit consequences.

In the letter, it was stated that title loans of $6 billion were obtained by 1 million consumers on an annual basis and mentioned that this industry, worth $38 billion, was small in comparison with the payday loan industry.

They also mentioned that title loans on average, were under $1,000 and were repaid within a six month period. And since low credit scores would pose a problem in obtaining loans from commercial banks, therefore, auto title loans are the legitimate option that small business owners and individuals usually opt for.

The details of the letter also argued the fact that only a percentage of 6 to 8 cars are repossessed. Whereas the Center for Responsible Lending accounted that almost 17% of auto title loan customers face fees of repossession. Uriah King mentioned that there was no way for them to know the amount of cars that are ultimately repossessed.

Responsible Lending

According to the Center for Responsible Lending, assessments of the ability of borrowers to repay loans should be conducted by title loan firms before they can issue loans and interest rates should be capped at 36%.

According to the Center for Responsible Lending, assessments of the ability of borrowers to repay loans should be conducted by title loan firms before they can issue loans and interest rates should be capped at 36%.

More details can be obtained in the full report by Uriah King.

Download this infographic.