0

0 0

0 0

0 0

0The Law in Alaska

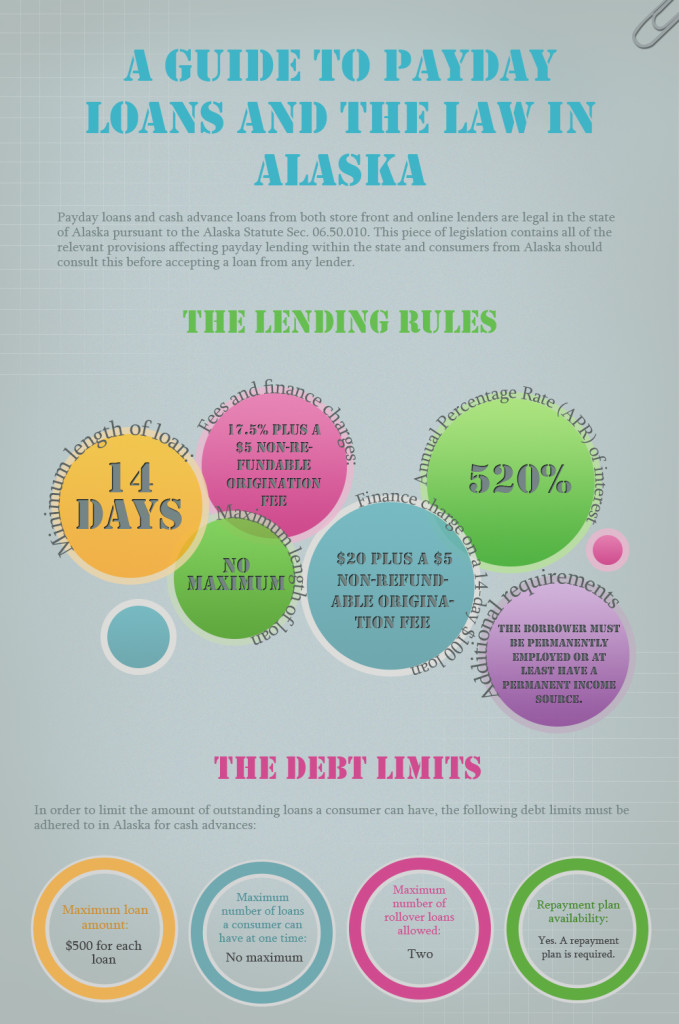

Payday loans and cash advance loans from both store front and online lenders are legal in the state of Alaska pursuant to the Alaska Statute Sec. 06.50.010. This piece of legislation contains all of the relevant provisions affecting payday lending within the state and consumers from Alaska should consult this before accepting a loan from any lender.

Options for residents

Alaskans keen on pursuing options from storefront lenders within the state can visit www.yell.com or perform a Google search to find a number of options. For those looking for a faster and more convenient way to find reputable lenders, CashAdvanceOnline.net can help you! We offer a free introduction and comparison service that can be access within minutes, with high rates of approval for payday loans from leading online lenders.

Alaskans keen on pursuing options from storefront lenders within the state can visit www.yell.com or perform a Google search to find a number of options. For those looking for a faster and more convenient way to find reputable lenders, CashAdvanceOnline.net can help you! We offer a free introduction and comparison service that can be access within minutes, with high rates of approval for payday loans from leading online lenders.

The Lending Rules

The following lending rules must be compiled with:

- Maximum loan amount: $500

- Minimum length of loan: 14 days

- Maximum length of loan: No maximum

- Fees and finance charges: 17.5% plus a $5 non-refundable origination fee

- Finance charge on a 14-day $100 loan: $20 plus a $5 non-refundable origination fee

- Annual Percentage Rate (APR) of interest: 520%

- Additional requirements: The borrower must be permanently employed or at least have a permanent income source.

The Law in Alaska Infographic (scroll down if you want to use it on your website)

The Debt Limits

In order to limit the amount of outstanding loans a consumer can have, the following debt limits must be adhered to in Alaska for cash advances:

- Maximum loan amount: $500 for each loan

- Maximum number of loans a consumer can have at one time: No maximum. A consumer can have as many payday loans as they need, each to a maximum of $500 per loan.

- Maximum number of rollover loans allowed: Two. If the consumer is unable to repay their loan on the agreed upon date, they are permitted to roll this over twice. This means that the lender can roll the loan over every time for 14 days more, for a total of 28 additional days each time taking the finance charge.

- Repayment plan availability: Yes. A repayment plan is required.

Regulatory information

Consumers should check to see that a payday lender is state chartered in Alaska. If an Alaska resident is offered a cash advance that doesn’t comply with the of the above rules, or from a non-state chartered lender, consumers should get into contact with the State of Alaska Division of Banking & Securities to protect themselves and exercise their statutory rights:

- Name of Regulator: Division of Banking & Securities

- Address: Department of Commerce, Community and Economic Development, State of Alaska Division of Banking & Securities, 550 West 7th Avenue, Suite 1850, Anchorage, AK 99501

- Phone: (907) 269-4584

- Website: www.dced.state.ak.us/bsc/banking

Be safe

You should only ever accept a cash advance from a lender that closely follows all of the relevant laws in your home state. It is important to do this for your protection and to ensure that the loan is covered by all of the necessary legislation in the event of a problem.

Don’t take a risk on an unregistered lender – We can help connect you to well-established online payday lenders in Alaska. It’s simple and takes only a couple of minutes to potentially get approved for that quick loan you need.

Click here to get started!

Download this infographic.