0

0 0

0 0

0 0

0 A private New York City-based research group called The Conference Board has released details of a consumer survey which paint a very bleak picture and show that American consumer confidence has fallen with many feeling pessimistic about job security, hiring and salary increases over the next 6 months.

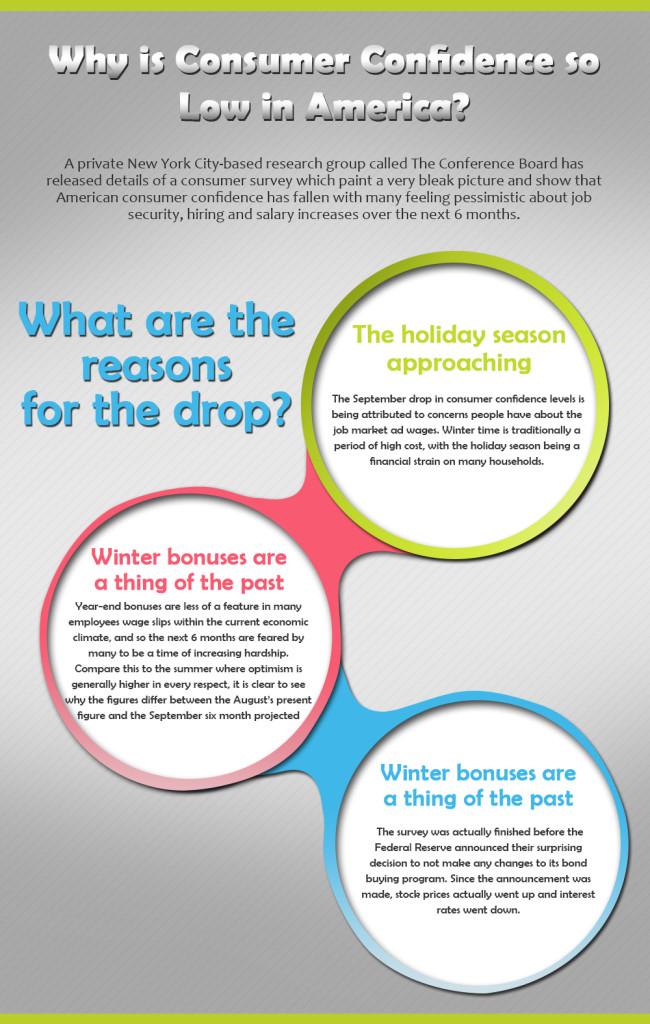

A private New York City-based research group called The Conference Board has released details of a consumer survey which paint a very bleak picture and show that American consumer confidence has fallen with many feeling pessimistic about job security, hiring and salary increases over the next 6 months.

The survey measured consumer confidence in August 2013 and rated it at 81.8. However, in September this dropped to 79.7. A reading in the 90 and above range is that which typically indicates a healthy economy, with good employment levels, good salary increases and solid retail statistics.

What are the reasons for the drop?

There may be several reasons why consumers are predicting a tough winter financially. Those are:

1) The holiday season approaching: The September drop in consumer confidence levels is being attributed to concerns people have about the job market and wages. Winter time is traditionally a period of high cost, with the holiday season being a financial strain on many households.

2) Winter bonuses are a thing of the past: Calendar year-end bonuses are less of a feature in many employees wage slips within the current economic climate, and so the next 6 months are feared by many to be a time of increasing hardship. Compare this to the summer where optimism is generally higher in every respect, it is clear to see why the figures differ between the August’s present figure and the September six month projected figure.

3) Higher interest rates and lower stock prices: The survey was actually finished before the Federal Reserve announced their surprising decision to not make any changes to its bond buying program. Since the announcement was made, stock prices actually went up and interest rates went down.

Consumer Confidence Infographic (scroll down if you want to use it on your website)

What are the consequences of consumer confidence being low?

Cautious spending is the bottom line when consumers brace themselves for a bumpy ride financially. Traditionally, the retail, real estate, vehicle, tourism and technologies sectors are hit the hardest when consumer confidence takes a dip.

When households and individuals expect a hard financial period to follow, they tend to tighten their belts, spend less and save more. Consequently, large, expensive or “luxury” items or expenditures are made less and less as consumers focus on putting their salaries towards everyday essentials such as rent, mortgage, bills, debts, gas, groceries and food. This means that major industries will be less profitable, and there may be a greater possibility for job loss within “luxury” sectors.

What can make consumer confidence increase?

Economists speculate that if equity prices continue to strengthen and gasoline prices drop, consumer confidence will start to rebound back to more buoyant levels. The indications are good, according to the AAA, as the average price in the U.S. for a gallon of gasoline was $3.46 last week, making a gallon of gas 8 cents cheaper than in August 2013. There would also need to be significant increases in the number of jobs secured, as the Jobs Report is a good indicator of economic stability. In addition, house prices need to regain momentum in order to reassure consumers further.

Download this infographic.