0

0 0

0 0

0 0

0For prospective borrowers living within the U.S. states which prohibit payday loans, there are a number of great alternatives.

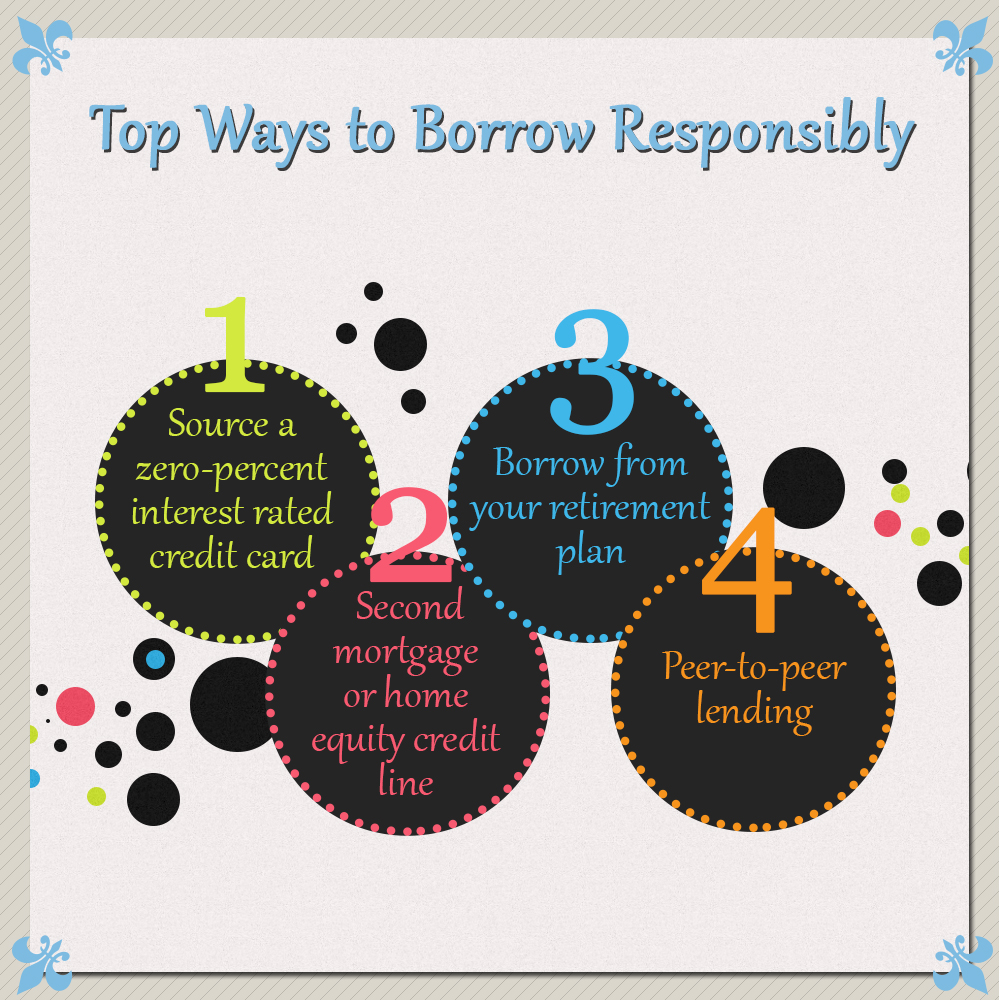

CashAdvanceOnline.net shows consumers how to make good choices for responsible borrowing. Here is a list of some with the pros and cons of each:

CashAdvanceOnline.net shows consumers how to make good choices for responsible borrowing. Here is a list of some with the pros and cons of each:

1. Source a zero-percent interest rated credit card

If you are in need for extra cash for purchases or in order to reshuffle some pre-existing debts and lower your repayments, a 0% credit card is a good option to consider for a short-term stop gap.

PROS: Credit card companies routinely offer special promotions for no-fee balance transfers and zero-percent interest rates cards. Usually, the promotional periods last for between 6 – 18 months.

CONS: Be aware that when the grace period ends, the interest rates can revert to something in the 25 percent range.

TIP: Make a note in your diary or calendar to allow for plenty of time to pay off the balance before the interest rate increases.

2. Second mortgage or home equity credit line

If you are a homeowner, obtaining extra cash from your mortgage will enable you to enjoy a low-cost form of borrowing. This type of borrowing can be responsibly used for large debts, educational costs or emergency medical bills.

PROS: If you have a cash emergency in need of a more considerable sum of money, a second mortgage might be able to offer cash equity for as little as 4 percent.

CONS: Remember that this loan is secured against your home as collateral, so it is especially important to keep up with repayments or else your home could be at risk.

TIP: Do your research and be discerning in finding a company that provides you with the best terms and lowest interest rates.

Borrow Responsibly Infographic (scroll down if you want to use it on your website)

3. Borrow from your retirement plan

If you have a 401(k), it might be possible to obtain a loan if your employer has included lending criteria in the plan. This type of loan is not advisable for day-to-day costs; rather it is better suited to something more major like a large purchase or one-off big expense.

PROS: This method of borrowing is responsible as the interest rates are low. Even better is that as you are both the lender and the borrower, the interest goes back to you in your retirement plan.

CONS: However, a word of warning is that if you lose your job, the loan will need to be repaid within two months or less or taxes and penalty payments will be levied.

TIP: The amount that it is possible to borrow depends on the terms of your retirement plan and the companies’ limits. In general, the most allow their account holders to borrow up to one-half of the balance in the account, to a total maximum of $50,000.

4. Peer-to-peer lending

Peer-to-peer lending is a new and enterprising way to look for low-rate loans as well as an opportunity to invest.

PROS: Peer-to-peer lending can also be an investment opportunity.

CONS: The rates of interest applicable to the loan will depend on the credit status of the prospective borrower, so this option is probably better for individuals with decent credit scores seeking short-term loans.

TIP: There are several resources online where would-be borrowers can look for a lender. Two such sites are Lending Club and Prosper.

Get more tips with CashAdvanceOnline.net

Download this infographic.